Property Making an investment For Newbies

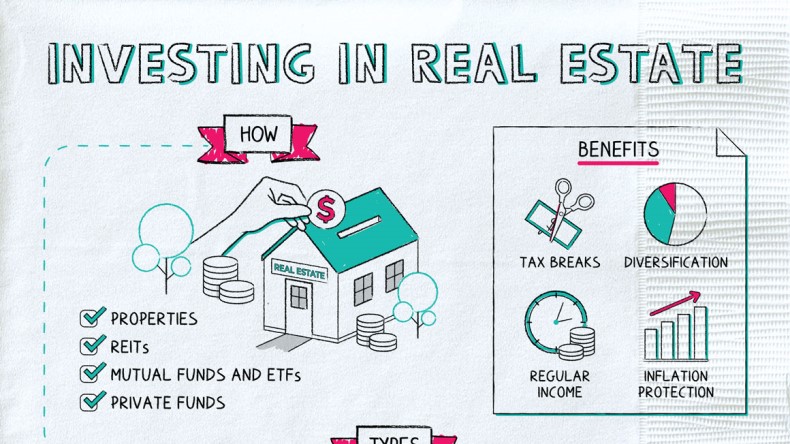

Real estate investing is an superb strategy to diversify your portfolio and produce residual income, but it is necessary that you completely understand its risks and exactly how advisable to mitigate them.

When looking for house, ensure that the associated fees including routine maintenance, insurance and taxation are considered when making your option. In addition, it may help when your choice requirements is clearly mentioned.

Investing in REITs

Novices looking for an great way to start off investing in real estate will benefit from thinking about REITs as an straightforward entryway into how to invest in homes real-estate shelling out. REITs are companies that very own and run a stock portfolio of business, manufacturing, and home real estate property qualities. REITs usually pay out benefits to shareholders leading them to be a very good way for beginners to get started real-estate purchase when they lack time or solutions to shell out specifically.Look at getting hire home as another means of real estate investment, since this strategy delivers both constant income from renters and also long term appreciation possible. But be skeptical for any taxes or maintenance commitments when booking out residence - these will have to be met if booking it is about the kitchen table!

Also, to produce making an investment reasonably priced for newbie buyers, they will likely call for having the capacity to manage an advance payment that may be quite sizeable. For that reason, it is essential which they carefully analyze their financial situation before making a determination in ideal circumstances they might possess enough water financial savings for a down payment and possessing strong credit ratings which allow for reduce personal loan charges.

Real-estate assets are especially worthwhile for novice buyers because they supply numerous tax rewards and write offs, such as reasonable property possession charges, operations and managing fees, depreciation allowances and depreciation allowances - these reductions can significantly lower ownership expenses although raising cashflow.

House principles have a tendency to depreciate over their useful daily life, that helps lower its taxable benefit and enhance after-tax statements. As a result, new real estate property investors must understand the numerous forms of depreciation and how it influences a property's selling price.

One of the better approaches to discover real estate property investing is through studying textbooks. These texts may help you pick an investment ideal for you whilst instructing you on basic principles from the industry and advice on maximizing profits. An effective starting point would be the book "What Every Real Estate Entrepreneur Requires To Know About Cash Flow," which offers functional direction for valuing components using various metrics.

Investing in Real Estate Syndicates

Real estate property investment is among the ideal way to diversify your investment stock portfolio, following the theory "don't put all your eggs in one basket". Real-estate offers tangible possessions which could increase over time - perfect if market place imbalances grow to be a challenge.Before diving into real estate property committing, it's essential that you obtain just as much understanding of the marketplace as you possibly can. Reading through textbooks about this is a very good starting point but seasoned investors can offer crucial guidance through joining real-estate situations or signing up for local marketing groups. Podcasts and webinars provide outstanding skilled ideas that are reachable from the area globally - this will make for priceless starting up sources!

Property syndication is surely an eye-catching method for newcomers to the real estate purchase planet, delivering usage of attributes without the irritation of purchasing and managing them themselves. Comparable to crowdfunding, this strategy calls for contributing a minimum sum to acquire an acquisition share in the property even so, traders should remember that this sort of investments might not be fluid enough and could take some time prior to being offered off completely.

Real estate property syndication can offer brokers with important profits, specifically newcomers without enough funds to get their particular home in full. By splitting income of jobs among numerous participants and enjoying income tax write offs in their purchase stock portfolio.

Real estate investors looking for their very first real estate property investments can generate cashflow by hiring out their residence to tenants, providing a pleasant supplement to cash flow in addition to aiding pay down their own house loan more quickly. Answer to profitable property syndication is in getting components by using a positive cash flow and respect potential.

Purchasing Lease Qualities

Leasing is a great option if you are prepared to key in real estate investment but tend not to desire to think the potential risks associated with owning and as being a property owner, whilst still searching for monetary benefits from hire income and collateral progress. As well as creating cash flow, renting qualities allows you to develop collateral while making the most of taxes positive aspects. Property purchases offer you great diversification benefits while raising cash flow - nevertheless hazards really should not be overlooked! To reduce dangers associated with real-estate shelling out it's smart to read textbooks linked to committing and attend network situations to higher be aware of the business - to gain as much understanding as you can about real-estate committing before plunging in go initially!Real estate property syndicatation can even be an attractive option for newbie investors, that involves pooling funds together so that you can purchase or create real-estate and be part of revenue from rental control charges, regular monthly cashflow from hire payments and funds gratitude. There are numerous benefits associated with this type of investment but novice buyers needs to be sure they spouse using a respected real-estate syndicator.

One of the most well-known ways of purchasing real estate property is by renovating properties. Following the BRRR technique (purchase, rehab, hire, re-finance and perform repeatedly), you can get attributes that may yield profits after renovation - perfect for newbie brokers with much less income and work to make. Keep in mind, however, that many factors such as place, marketplace tendencies and fees could impede revenue in some instances.

If you choose a dynamic procedure for real estate property investing, attempt turning properties. This strategy provides an effective short-expression method of strengthening a stock portfolio to see if real estate property fits your lifestyle. Flipping can provide an easy way to evaluate whether property suits you before diving deeper.

To be successful at property shelling out, it's essential that you are currently knowledgeable of your sector and possess an excellent business strategy plan. In addition, take a moment to take into account what sort of entrepreneur you aspire in becoming subsequent these tips might help you stay away from some popular real-estate committing errors and grow an accomplished trader.

Investing in Flipping Qualities

Real estate property expense is surely an eye-catching strategy to produce extra resources and can also be rewarding for starters. But before diving in, brokers must completely how can i become a real estate investor grasp both risks and rewards before investing. They should broaden their investments, use a contingency strategy in place in case something unexpected shows up and enough investment capital protected up just in case their house does not market additionally they may consider utilizing influence as part of their method so that you can boost odds of success.Beginners planning to enter in real-estate will benefit from flipping components. This requires buying houses which need repairs or renovations and marketing them in a income. It is key to find components with both a very high purchase cost and probable revenue from an Accent Home Device (ADU), located in desirable local neighborhoods with ample space for development of an ADU.

Leasing out home can be another efficient way of earning profit real estate, since it doesn't demand upfront funds. But it is crucial that you know your neighborhood market well so that you can establish communities with solid requirement for lease property - this will help you to give attention to finding correct qualities and discuss relates to landlords.

To put it simply, you can now come to be a highly effective real estate investor with the appropriate information and way of thinking. Make certain you broaden your portfolio, be aware that industry circumstances transform over time, steer clear of obtaining trapped in real property bubbles and not put all your eggs in a basket.

Before starting any real estate property making an investment quest, it's crucial to have a prepare and set of targets prior to starting. Choose whether you intend to flip properties or buy rental property, network with many other investors, and participate in real estate shelling out training seminars as another great way of learning more about the marketplace and meeting other traders - but be careful not to get confused by information!